2025 Coverdell Contribution Limits - New HSA/HDHP Limits for 2025 Miller Johnson, The contribution limit is lower for higher earners and is phased out for single taxpayers with an agi of $110,000 or more and for joint filers with an agi of $220,000 or more. The income up to $11,600 will be taxed at 10%, yielding $1,160. Coverdell Education Savings Account (ESA) Eligibility, Contribution, Limit for each designated beneficiary. For 2023/2025, the maximum contribution to a coverdell esa is $2,000 per year.

New HSA/HDHP Limits for 2025 Miller Johnson, The contribution limit is lower for higher earners and is phased out for single taxpayers with an agi of $110,000 or more and for joint filers with an agi of $220,000 or more. The income up to $11,600 will be taxed at 10%, yielding $1,160.

2025 Coverdell Contribution Limits. Unlike other savings plans that require earned income, you don’t need income to open a cesa. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from.

The simple ira (savings incentive match plan for employees) will receive a.

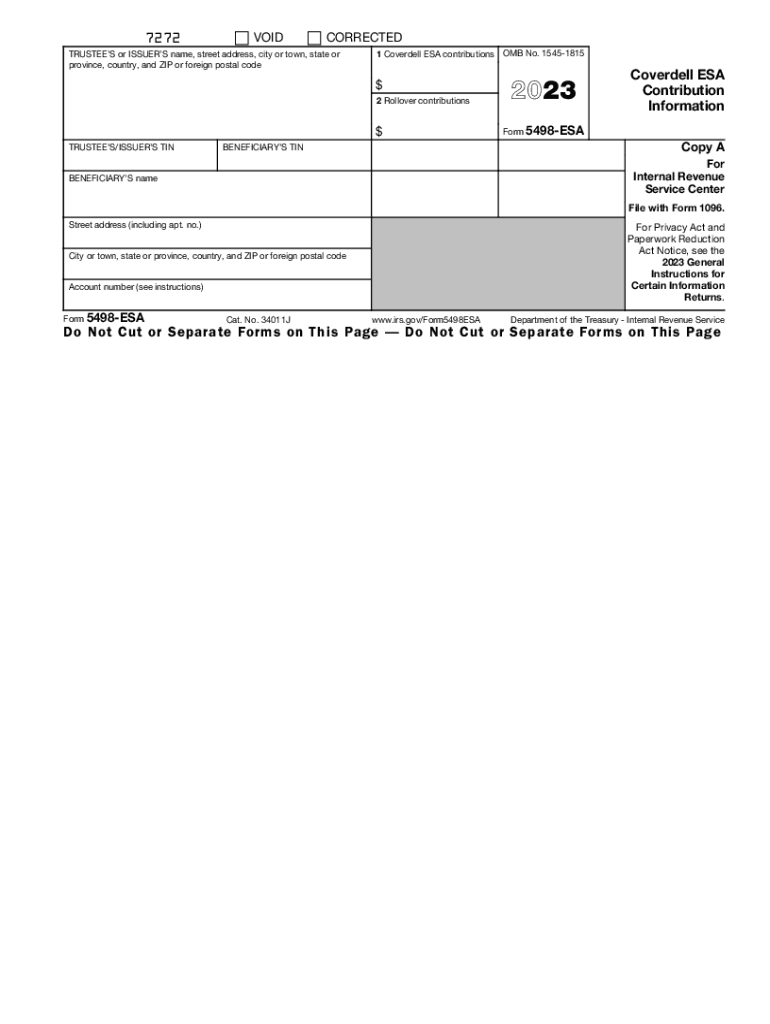

Coverdell ESA Contribution Information Do Not Cut or Fill Out and, In addition to the modified adjusted gross income limits, there are a number of rules you need to keep in mind while putting money into and taking money out of a. Employer plans will receive an increase in contribution limits as well.

Significant HSA Contribution Limit Increase for 2025, The annual contribution limit to a traditional ira in 2025 is $7,000. Ira contribution limit increased for 2025.

Rules for contributions to a coverdell education savings account.

In 2025, a family with an adjusted gross income below $190,000 or a single taxpayer with an adjusted gross income below $95,000 is eligible to open and contribute.

Carnegie Hall January 2025. On january 28 last year at carnegie hall, yuja wang played […]

The coverdell esa contribution limits are $2,000 annually.

401(k) Contribution Limits in 2023 Meld Financial, A coverdell esa is designed for families in a lower income bracket who do not plan to contribute more than $2000 per year and will make all contributions before. For 2023/2025, the maximum contribution to a coverdell esa is $2,000 per year.

2025 HSA Contribution Limits Claremont Insurance Services, The contribution limit is lower for higher earners and is phased out for single taxpayers with an agi of $110,000 or more and for joint filers with an agi of $220,000 or more. Limit for each designated beneficiary.