2025 Amt Exemption Images References : - 2025 Amt Exemption. Taxpayers who have incomes that exceed the amt exemption of $88,100 (single), $137,000 (married filing jointly) and $68,500 (married filing separately) in 2025 may be subject to the. This tax reform measure increased the base amt income exemption amount that's subject to inflation bumps, as well as hiked the threshold at which… Amt Exemption 2025 Nyssa Arabelle, Bloomberg tax anticipates that the exemption amounts will look like this in 2025:

2025 Amt Exemption. Taxpayers who have incomes that exceed the amt exemption of $88,100 (single), $137,000 (married filing jointly) and $68,500 (married filing separately) in 2025 may be subject to the. This tax reform measure increased the base amt income exemption amount that's subject to inflation bumps, as well as hiked the threshold at which…

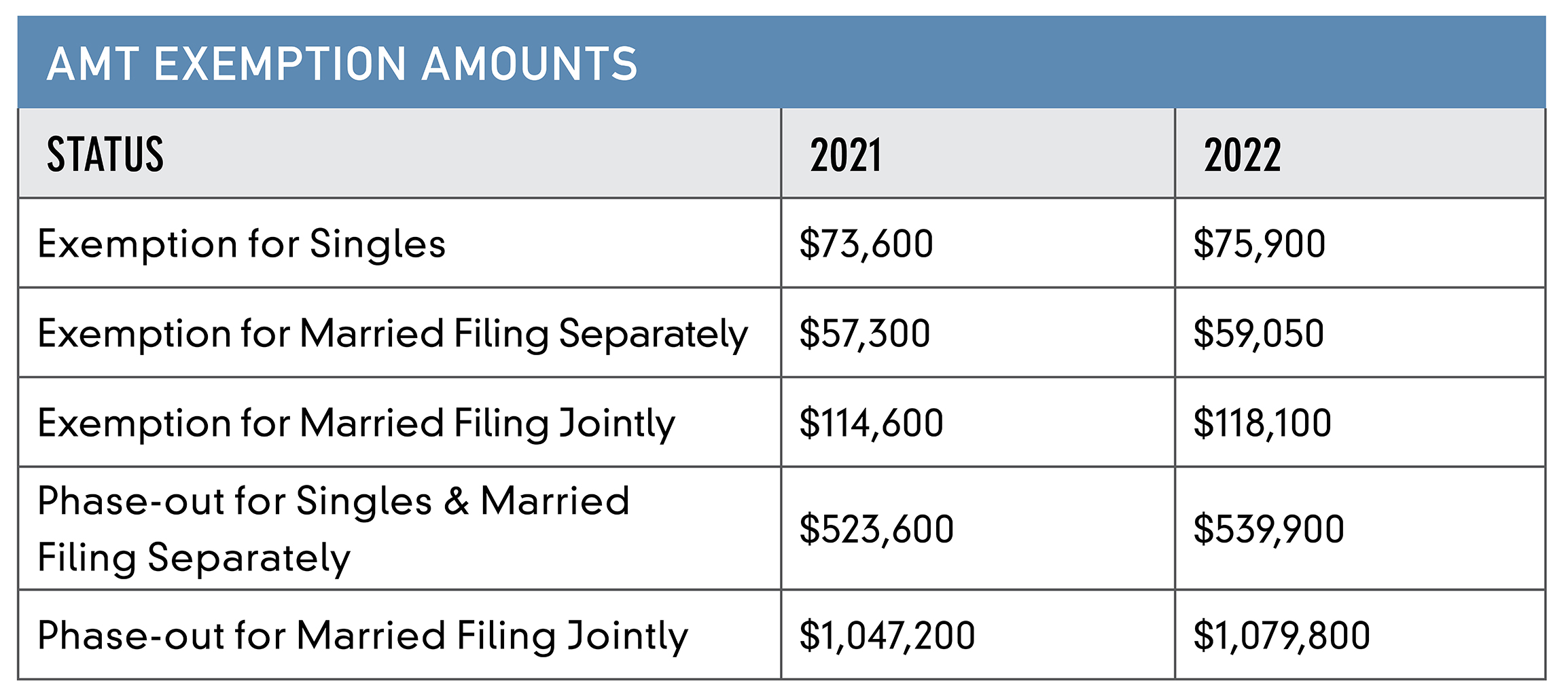

Amti Exemption 2025 Bonnee Vilhelmina, The table below illustrates the anticipated amt exemptions for 2025.

Amti Exemption 2025 Bonnee Vilhelmina, The amt exemption amount for tax year 2025 for single filers is $88,100 and begins to phase out at $626,350 (in 2025, the exemption amount for single filers was $85,700.

FPA Northeastern New York Chapter October 18, ppt download, For tax year 2025, the amt exemption for single filers is $85,700.

However, the brackets that apply to different rates will expand. The amt exemption amount is reduced or eliminated with income above these amounts.

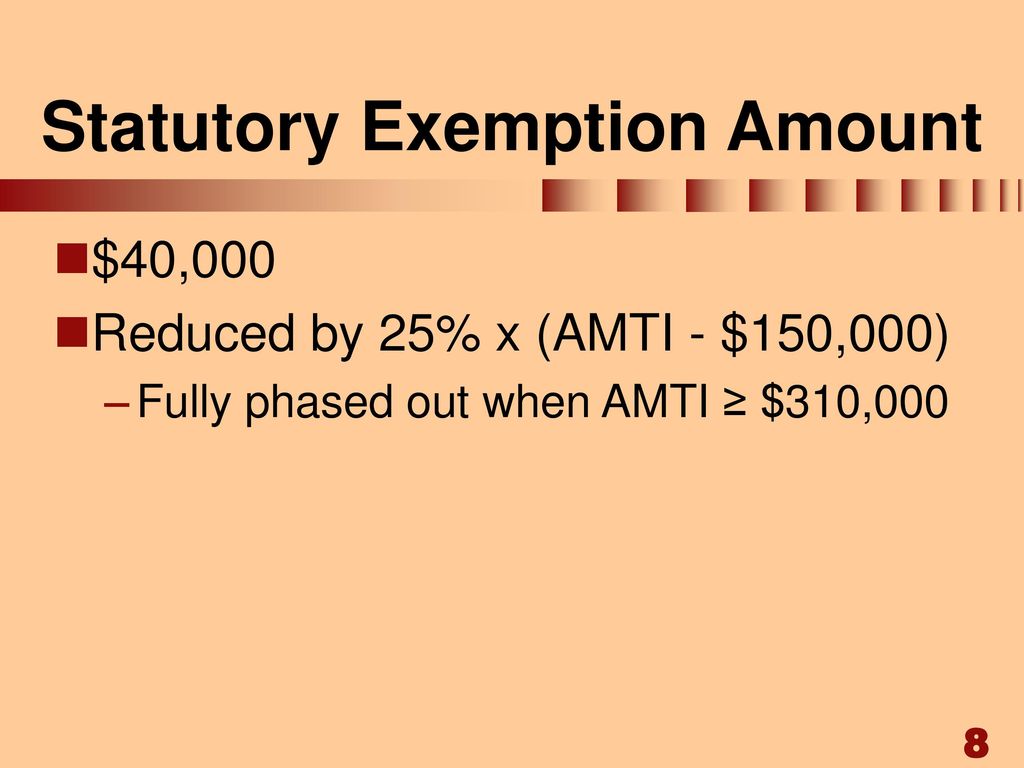

Amt Exemption 2025 Nyssa Arabelle, If the provision expires in 2025 as planned, we can expect rates to revert back to lower 2025 amounts.

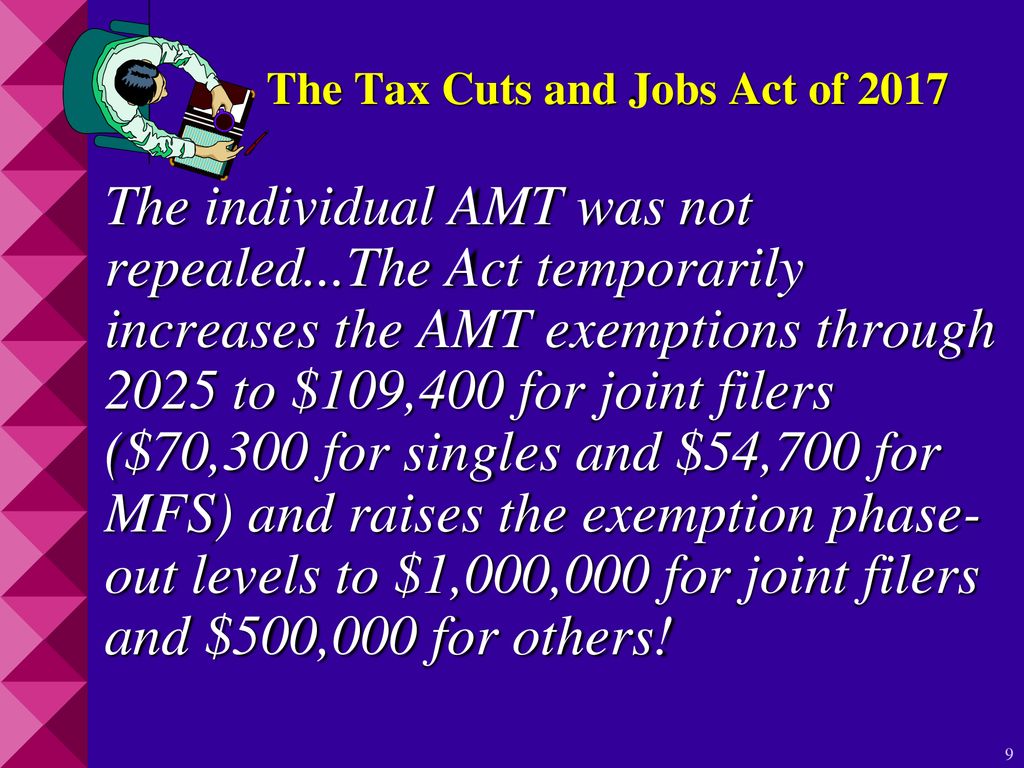

2025 Amt Exemption. Taxpayers who have incomes that exceed the amt exemption of $88,100 (single), $137,000 (married filing jointly) and $68,500 (married filing separately) in 2025 may be subject to the. This tax reform measure increased the base amt income exemption amount that's subject to inflation bumps, as well as hiked the threshold at which that exemption phases out.

Amt Exemption 2025 Nyssa Arabelle, Another tcja change also lessened the amt impact.

Amti Exemption 2025 Bonnee Vilhelmina, However, the brackets that apply to different rates will expand.

Amt Exemption 2025 Nyssa Arabelle, The 2025 tax cuts and jobs act (tcja) increased amt exemption amounts.

Mfj Standard Deduction 2025 Molly, The amt exemption amount for tax year 2025 for single filers is $88,100 and begins to phase out at $626,350 (in 2025, the exemption amount for single filers was $85,700.

Amti Exemption 2025 Bonnee Vilhelmina, You can use tax credits to decrease the amt that you owe.